Back in spring 2018, Opera Europa presented a piece of research that mapped members’ financial models and artistic outputs, drawing on a combination of data in the public domain and a bespoke survey. Just as Opera Europa’s research activities were gaining new momentum… the pandemic.

Fast forward to summer 2023 and Opera Europa renewed its efforts, with the launch of a standardised annual member survey. The plan? To create a meaningful longitudinal study of Opera Europa’s membership.

Huge thanks to all members who completed the member surveys in summer 2023 and 2024. We know that sinking feeling when a request lands in your inbox with yet another thing to add to the “to do” list! However, we also know that having a substantial annual set of data about the opera and ballet sector, comparable from year to year, will allow us to understand how the sector is evolving, to advocate on its behalf and support your organisations as effectively as possible. We look forward to strengthening the research we do on behalf of the sector over the coming months and years, enabling us all to speak up even more convincingly for opera and dance.

In Torino, we presented some key findings from our three datasets (pre-pandemic, plus the two annual member surveys). Here we recap on some of the key findings.*

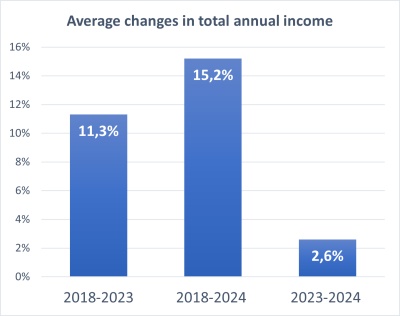

Average income (fig 1)

On average, members’ annual income has increased by 15.2% between pre-pandemic times and the 2022-23 season. However, let’s not forget that average inflation in the EU in 2022 was 9.2% and in seven countries was in fact over 15%. Right across the EU, inflation was over 17% for water, electricity and gas.

Behind the overall positive trajectory in average annual income is a more complex picture. From pre- to post-pandemic times, a quarter of organisations reported a decrease in annual income. Those decreases ranged from 1.3% to 23.3%. In the latest data, there is now a higher proportion of companies reporting a decrease in annual income, though those decreases are less dramatic compared with previous times.

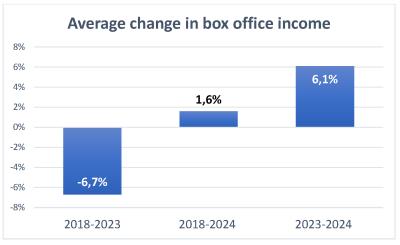

Box office income (fig 2)

Of the respondents to Opera Europa’s 2024 survey, box office income ranges from 8500€ to nearly 80 million! Overall, the hit to box office income that accompanied the pandemic is reversing. It is difficult to discern patterns according to country or region, though we can see that festivals performed more robustly at box office than stagione or repertoire models.

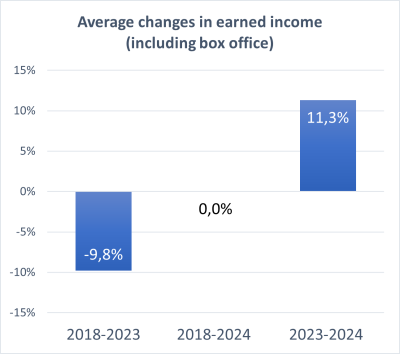

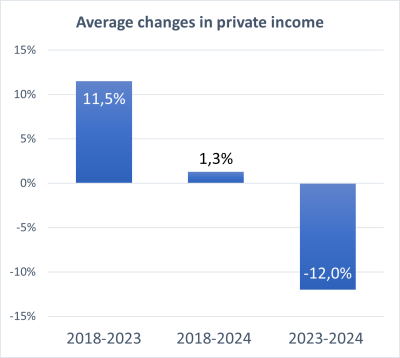

Earned and private income (fig 3 & 4)

Data on earned and private income tells a fascinating story. Earned income, as you might expect, follows much the same pattern as box office income: a hit during the pandemic, stabilising as the world returned to some semblance of normality and growth in the last two seasons. Private income, on the other hand, shows the opposite pattern. Does this suggest that organisations are having to offset losses in private income with new approaches to securing revenue?

Average proportion of available tickets sold

On average, respondents to the 2023 survey reported selling 69.2% of available tickets. However, individual results ranged from 95.9% at the top end to just 14.3% for those who struggled most with ticket sales. The results in 2024 show a sector moving in a positive direction: 78.1% of available tickets sold on average, and individual results ranging from 43.6% to 97.3%. In 2023 data, 16% of companies were selling fewer than 50% of available tickets. In 2024 data, that group is just 2%.

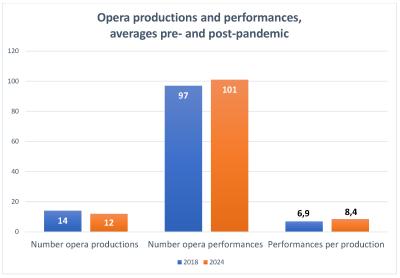

Number of productions and performances (fig 5)

To explore number of productions and performances, we filtered results to do a “longitudinal panel survey”, i.e. looking at variations in data from the same group of respondents over time. Results show that compared with pre-pandemic times, companies are on average presenting longer runs of fewer opera titles. While the number of opera performances has increased slightly by 4%, the number of productions is down by 14%. On average, where companies were presenting 6.9 performances per title in pre-pandemic times, they are now doing runs of 8.4 performances.

Looking ahead

In spring 2025, we will launch the next edition of the Opera Europa member survey. We look forward to inviting you to participate in due course! In the meantime, we are still welcoming members’ responses for the 2023 and 2024 member surveys. This will enable us to build robust data for future comparisons. If you have any thoughts or questions about Opera Europa’s research activities, don’t hesitate to contact hannah@opera-europa.org

* Please note: each survey gathers data on the preceding season or fiscal year, depending on how individual companies collate their data. Therefore, graph labels stating 2023 relate to the 2021-22 season or the 2022 fiscal year. The data collated in 2018 relates to various 12-month periods from 2015-17. Data from that period is not fully standardised with the member survey, but some crossover allows meaningful comparisons to be drawn.